Rating: NNNNN

It sometimes happens in politics that arguments close to sounding cogent can, upon closer inspection, become the very opposite.

Take the uproar by Denzil Minnan-Wong and others over council crying poor, then buying a failing playhouse (Theatre Passe Muraille).

Some in the public may have bought this one, but there’s a realm between understanding the issues and not understanding where many people understand just enough to really effectively misunderstand.

That’s why often the only news light enough to travel the valley is about “overspending” on cultural “frills” or complaints about over-taxing. Some councillors encourage these stories some likely dwell in the valley themselves. The disjunct between spending and rhetoric is similar to the one between capital and operating budgets. How about a metaphor?

“Your operating budget is your heat and your groceries, and your capital budget is your roof and your plumbing,” says Councillor Gord Perks of the Budget Committee. Okay, that works.

Operating is funded from taxes, with minimal help from other levels of government. Capital tracks, facilities, etc is funded mostly by loans and moderate government assistance.

The capital budget is under control in the short term, the city’s credit rating being “A++” one reason it hasn’t come up. That city managers would very much like to pre-empt any talk of patching operating gaps with capital dollars is likely another.

And here we reach the gooey centre. There are routine objections to expanded capital spending. Former budget chief David Soknacki recently published an op-ed to that effect, while a touchy city press release responded with the official line that capital and operating are two solitudes.

Yes and no. A percentage of taxes (17 per cent in 2007) goes toward capital (4.5 per cent of the budget this year), and a percentage goes to capital debt service (12.6 per cent this year.) Each year, debt grows by about $250 million, while the city retires about $200 million. And capital spending incurs future operating costs: if you build a library, you need to light it and pay staff.

But capital spending can also save or generate money. “If we build a library, why should I pay for it all now, when benefits will come over 50 years?” says Budget member Joe Mihevc. This results in capital assets, and hopefully invites development, raising property values and hence property taxes.

Miller opponents David Caplan and Case Ootes are pushing to cut capital or reallocate it to operating budgets. And though the administration was careful not to put it this way, that’s what happened when City Hall office renovations were suspended following the failed tax vote.

Slowed capital spending can slow operating revenues by freezing development, driving away transit riders or simply raising the cost of repairs. Most current capital expenditures are earmarked “state of good repair,” and Perks points out that over half are on transit. He has little time for people targeting capital spending. “You can argue about whether you’re keeping lights on too long, but when you’ve got a hole in the roof, you patch it,” he says.

On the other hand and Perks would agree it’s hard to cry necessity about something like the Front Street Extension project hoarding unspent millions when the plans to topple the Gardiner, which necessitated it, are essentially dead.

The criteria for distinguishing investment from trophy spending are hazy, and the definition of “state of good repair” seems up for grabs. And it’s hard to say if redesigning Nathan Phillips Square is in the SGR category.

Mihevc says it is. “Say your porch is falling apart. Do you repair it or do you add a new room out front for $10,000 more?” he says. Well, if I weren’t sure I had the 10 grand, I might just repair. But if I knew I wanted a new room down the road, doing repairs could mean I couldn’t afford it later.

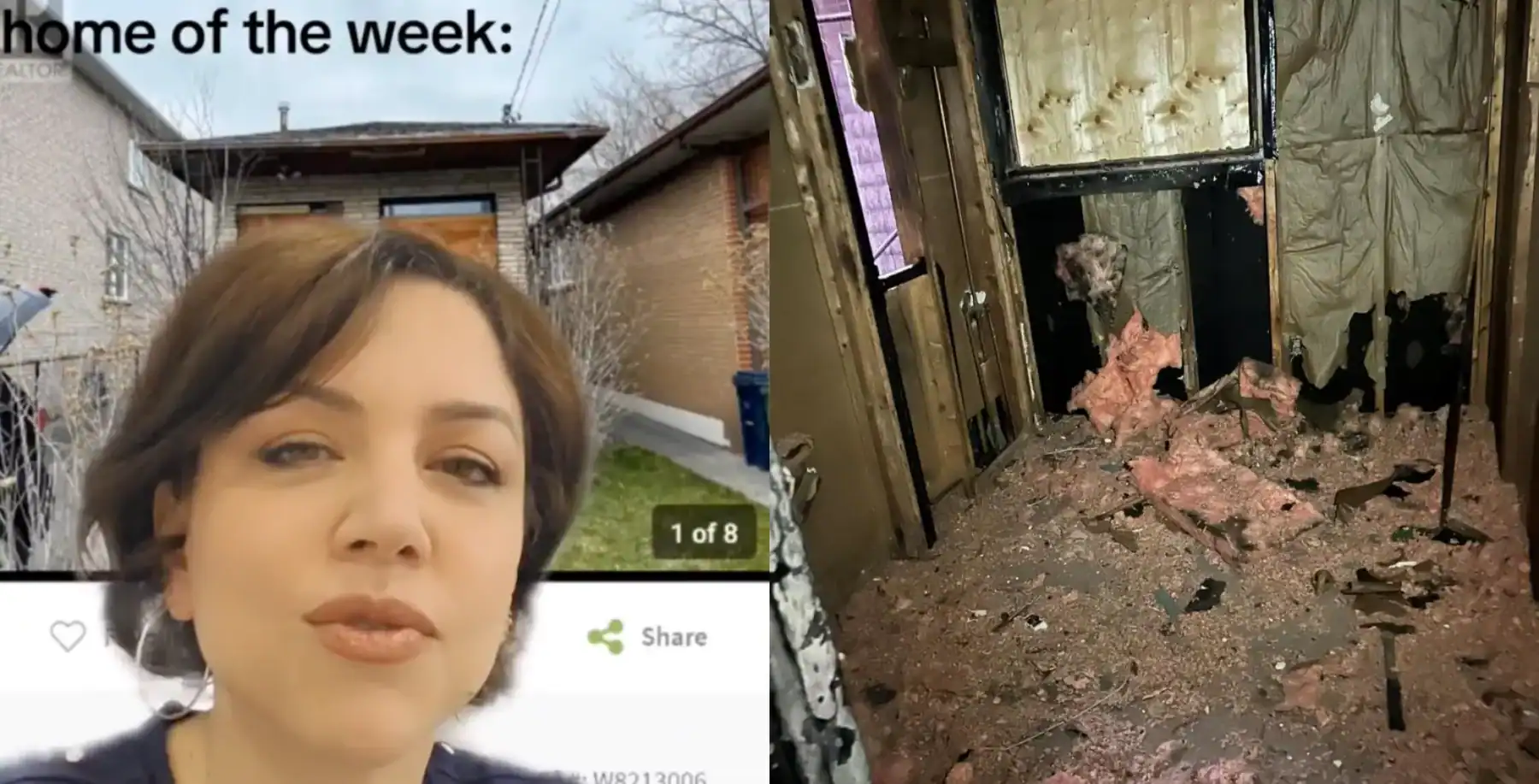

Ultimately, burning long-term infrastructure funds on operating emergencies not only robs the city of its dignity, but is akin to tearing up your walls to keep your fireplace burning.

It’s easy to wonder how long this can go on: issue debt, build to make money to pay off debt, and keep your credit rating high enough to get more.

The idea of constant growth seems like something all cities will have to confront. But not when we can only just afford essentials, and when negligible savings are trumpeted as solutions. They’re not, but they are savings, and best to lie using the truth, I suppose. And so, in the middle country, confusion reigns.